Economic Development Toolkit

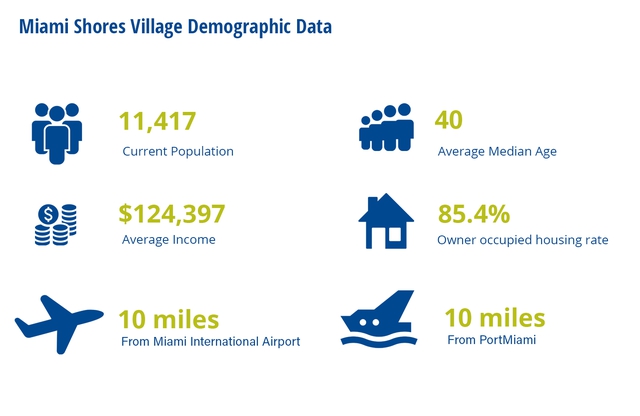

Whether you are a new business or a serial entrepreneur in town, we are delighted you chose to locate your business in Miami Shores Village. Our goal is to foster a healthy local economy through partnerships and support to large and small-scale businesses. We hope this toolkit provides important resources, from business grants, demographic data, steps to obtain a business tax receipts, to details about the Miami Shores Village Market. Consider this toolkit your one stop shop. We look forward to working with you to ensure your continued success.

Get help with Zoning Verification please contact:

Claudia C. Hasbun, AICPPlanning

Zoning & Resiliency Director

compplaninfo@msvfl.gov

Miami Shores Village Comprehensive Plan documents the long-term vision for the future.

Are you planning on opening up a new business in Miami Shores?

If, so please read our Guide to Opening A New Business

Are you planning on remodeling an existing business in Miami Shores?

Check out our easy permitting process here.

Are you expanding a local business?

Please contact our Staff for Zoning verification. Link to the Planning, Zoning and Resiliency page

Are you planning to relocate your business to Miami Shores?

You may qualify for local, state and federal incentives!

For more information on Statewide Incentives, please visit the Florida Department of Economic Development link to https://www.floridajobs.org/office-directory/division-of-strategic-business-development/economic-development-incentives-portal

All Applicants Must Submit:

- Application for Miami Shores Village Business Tax Receipt. This application may require approvals from various Departments within the Village and is dependent on the location of the business and the type of business.

- Payment of required fees for Business Tax Receipt

These Documents May Need To Be Submitted with Application:

- If the business is a corporation, LLC or partnership: A printout of the Sunbiz online records or copies of the business entity's filing documents can be found online.

- If using a fictitious name or "DBA": A printout of the Sunbiz online records or a copy of the Fictitious Name Registration.

- If your trade or profession is regulated by another federal, state or local agency: A copy of your registration, certification or license.

Home Based Business Applicants Must Also Submit:

- Proof of residence (i.e. copy of utility bill for the residential address in the applicant's name).

Commercial Business Applicants Must Also Submit:

- Verification of zoning, use, occupancy and any environmental requirements associated with operating a business in Miami Shores Village will occur before a Certificate of Use and Occupancy/Business Tax Receipt is issued.

- All new business locations are inspected to ensure compliance with life/safety, building, environmental and zoning code requirements. Any change made in receipt status, such as physical address change, ownership or name change will require a new Business Certificate of Use application.

- Multiple Licenses may be required.

- Business Tax Receipts are valid for one year, from October 1 through September 30.

- This information contained on this page is not intended to be all-inclusive; it is offered as a basic guide, providing general information.

For further questions, please contact the Code Compliance Office at 305-795-2207 Ext. 4861

Building Department: 305-795-2204 Planning & Zoning: 305-762-4864 Neighborhood Services: 305-762-4863 Hours are Monday - Friday 8:30 AM – 5:00 PM